Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies to profit from changes in their values. It’s a dynamic and fast-paced market that attracts traders of all experience levels. What Is Forex Trading and How Does It Work is a crucial question for anyone looking to succeed in this field. At Forex Ascenders, we offer a Free Online Forex Platform where you can learn the ins and outs of Forex trading. Our platform also provides Forex Training Q&A Recorded Sessions to help you navigate this complex market with confidence.

What is Forex?

The foreign exchange market, commonly referred to as “forex” or “FX,” is the largest and most liquid financial market in the world. It operates on a global scale, allowing participants to trade currencies in a decentralized environment. Unlike traditional stock markets that operate within specific hours, the forex market is open 24 hours a day, five days a week, facilitating continuous trading as various global financial centers operate in different time zones. This market is driven by a diverse array of participants, including central banks, financial institutions, corporations, hedge funds, and individual traders, all of whom contribute to the constant fluctuations in exchange rates.

At its core, the forex market allows individuals and institutions to exchange one currency for another. The basic premise is straightforward: if you believe that one currency will strengthen against another, you can trade accordingly to potentially make a profit. For instance, if you anticipate that the euro will rise in value compared to the U.S. dollar, you might buy euros and sell dollars. If your prediction proves correct, you can later sell the euros at a higher rate, thereby making a profit from the difference.

The foreign exchange market plays a crucial role in global finance, as it facilitates international trade, investment, and tourism. Imagine traveling to a foreign country; you would need to exchange your local currency for the currency of your destination. This is a simple example of a forex transaction, where currency exchange booths at airports or banks allow travelers to convert their money. However, beyond these everyday transactions, the forex market is a complex and dynamic environment where currencies are traded in massive volumes, often with the intent of speculation or hedging against risks.

Forex trading has evolved significantly over the years, particularly with the advent of digital platforms that allow individual traders to participate in the market from anywhere in the world. These platforms provide access to real-time data, charting tools, and various trading instruments, making it easier for both novice and experienced traders to engage in currency trading. However, the forex market is also highly volatile and requires a deep understanding of market dynamics, economic indicators, and geopolitical events to navigate successfully.

What is Forex Trading?

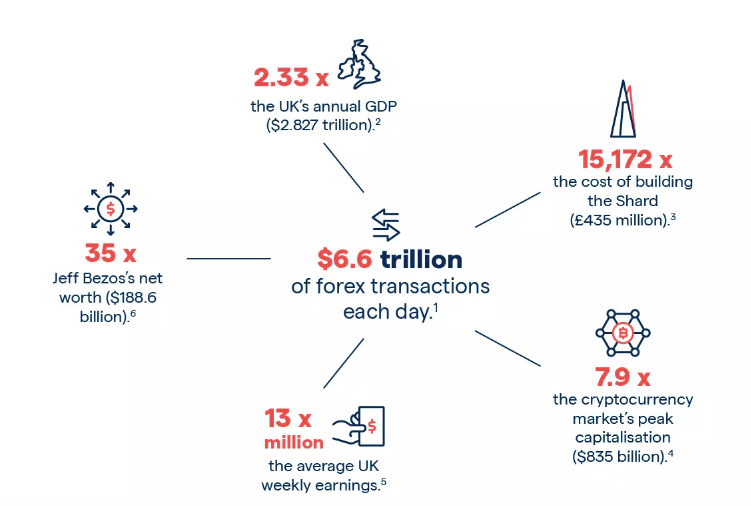

Forex trading, also known as foreign exchange or FX trading, involves the conversion of one currency into another. This global market is one of the most actively traded financial markets in the world, with a daily trading volume exceeding $6.6 trillion. Participants in the forex market include individuals, corporations, financial institutions, and central banks, all of whom contribute to the continuous flow of currency exchanges that occur around the clock.

While some currency exchange transactions are conducted for practical purposes, such as facilitating international trade or travel, the majority of forex trading is driven by speculation. Traders aim to profit from the fluctuations in currency exchange rates by buying a currency when they believe its value will rise and selling it when they expect its value to fall. This speculative trading can lead to significant price movements, making the forex market highly volatile and potentially profitable for those who can accurately predict market trends.

The appeal of forex trading lies in its accessibility and the potential for profit in both rising and falling markets. Unlike traditional investments, forex trading allows traders to speculate on currency pairs, where they simultaneously buy one currency and sell another. This means that a trader can profit not only when a currency appreciates but also when it depreciates, as long as they have correctly anticipated the market direction.

However, forex trading is not without risks. The high level of leverage available in forex trading can amplify both profits and losses, making it crucial for traders to have a solid understanding of market dynamics, risk management, and trading strategies. Additionally, the factors that influence currency prices are numerous and complex, ranging from economic indicators and central bank policies to geopolitical events and market sentiment.

What Is the Forex Market?

The foreign exchange market, commonly known as Forex or FX, is a global marketplace where currencies are bought and sold. Unlike traditional stock markets, the Forex market operates without a central exchange. Instead, trading takes place electronically over-the-counter (OTC), connecting a vast network of traders from all corners of the world. This decentralized nature allows for continuous trading and ensures that the market is always active, with prices fluctuating in real time.

One of the defining characteristics of the Forex market is its 24-hour operation, five days a week. Trading begins on Sunday at 5 p.m. Eastern Time (ET) in the Asia-Pacific region, starting with Sydney. As the day progresses, the market moves across time zones, with major trading centers in Tokyo, Hong Kong, and Singapore coming online. By the time the Asian session ends, the European session begins, with key markets in Paris, Frankfurt, Zurich, and London driving the bulk of trading activity. The day concludes with the North American session, centered in New York, before the market closes on Friday at 4 p.m. ET.

The Forex market’s global reach and constant activity make it one of the most dynamic financial markets in the world. Unlike other markets, where trading hours are limited, Forex traders can respond to economic events, geopolitical developments, and other factors in real time, no matter where they are located. This continuous trading environment also means that currency prices are always in motion, creating opportunities for traders to buy and sell based on the latest market trends.

How Does the Forex Market Work?

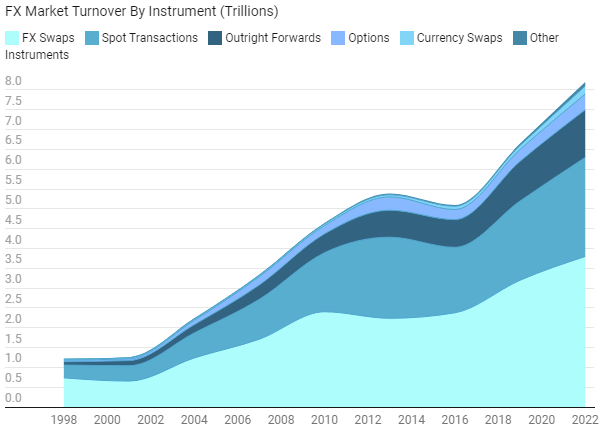

The Forex market, also known as the FX market, is one of the largest and most liquid financial markets in the world, operating 24 hours a day, five days a week. Unlike other markets, Forex trading does not take place on a centralized exchange but occurs over-the-counter (OTC), meaning that transactions are conducted directly between parties, typically through electronic trading platforms. While the market has traditionally been dominated by large financial institutions and corporations, the rise of online trading platforms has opened the door for retail traders to participate, leading to an increase in trading activity.

At its core, Forex trading involves the buying and selling of currencies in pairs, with the value of one currency being quoted against another. For example, in the GBP/USD currency pair, the market price indicates how many US dollars are needed to purchase one British pound. Traders speculate on the price movement of these currency pairs, aiming to profit from fluctuations in exchange rates. The Forex market is influenced by various factors, including economic data releases, geopolitical events, and central bank policies, all of which can cause significant volatility and create opportunities for traders.

One of the unique aspects of the Forex market is its accessibility, allowing traders to participate with relatively small amounts of capital. However, this accessibility also brings risks, particularly for inexperienced traders who may not fully understand the complexities of the market. The decentralized nature of Forex trading means that there is no central authority overseeing transactions, which has unfortunately made it a target for fraudsters looking to exploit less knowledgeable investors. As a result, it is crucial for traders to conduct thorough research and work with reputable brokers to ensure a safe and secure trading experience.

Pros and Cons of Trading Forex

Pros:

Largest Market in Terms of Daily Trading Volume in the World

The Forex market is the most liquid and largest financial market globally, with an estimated daily trading volume exceeding $6 trillion. This high liquidity means that traders can enter and exit positions quickly and efficiently, usually without large price fluctuations due to high volumes. The vast size of the market also ensures that there are always buyers and sellers available, making it easier to trade at the desired prices.

Traded 24 Hours a Day, Five Days a Week

Unlike stock markets that are limited by specific opening and closing hours, the Forex market operates 24 hours a day, from Monday to Friday. This is because Forex trading is conducted over-the-counter (OTC) and is decentralized, with trading sessions overlapping across different time zones (e.g., London, New York, Tokyo). This allows traders from around the world to trade currencies at almost any time of day, providing flexibility for part-time traders or those with busy schedules.

Starting Capital Can Rapidly Multiply

Forex trading offers the potential for significant returns on investment, even with a relatively small starting capital. The use of leverage, which allows traders to control larger positions with a smaller amount of actual capital, can amplify profits. For example, with 1:100 leverage, a trader can control $100,000 with just $1,000. However, while leverage can increase potential profits, it also increases the risk of losses, so it must be used cautiously.

Generally Follows the Same Rules as Regular Trading

Forex trading shares many principles with other forms of financial trading, such as stock or commodity trading. Traders in Forex analyze market conditions, use technical and fundamental analysis, and execute trades based on their market outlooks. Familiarity with general trading concepts like trend analysis, risk management, and trading psychology can be beneficial for those transitioning from other markets to Forex.

More Decentralized than Stock or Bond Markets

The Forex market is decentralized, meaning it does not have a central exchange like stock or bond markets. Instead, trading occurs directly between participants (such as banks, financial institutions, and individual traders) through electronic networks. This decentralization means that the market is less subject to manipulation by a single entity and can offer more transparency and fairer pricing. Additionally, it allows for more diverse trading opportunities and lower barriers to entry for individual traders.

Cons:

Leverage Can Amplify Losses

Leverage allows traders to control a large position in the forex market with a relatively small amount of capital. For example, with 100:1 leverage, you can control $100,000 with just $1,000. While this can magnify profits, it also increases the risk. If the market moves against your position, the losses are also magnified, potentially wiping out your investment much quicker than if you were trading without leverage.

Leverage in the Range of 50:1 or Higher Is Not Uncommon

Forex brokers often offer high leverage, sometimes as much as 400:1, but leverage of 50:1 or higher is common. This means that for every $1,000 in your trading account, you could potentially control $50,000 in the market. This high leverage can lead to substantial profits on small price movements, but it equally increases the risk of significant losses. Traders need to be very careful with how much leverage they use.

Requires an Understanding of Economic Fundamentals, Macro Factors, and Indicators

Successful forex trading requires knowledge of global economic conditions, including factors like interest rates, inflation, and economic growth. Traders need to understand how these macroeconomic indicators impact currency values. For example, a country’s high interest rates might attract foreign investors, leading to an increase in the value of its currency. Understanding these factors is crucial for making informed trading decisions.

Less Regulated Than Other Markets

The forex market is decentralized and operates 24 hours a day, with no central exchange like stock markets. This decentralization means there is less oversight and regulation compared to other financial markets, such as stock or futures markets. While many brokers are regulated by financial authorities, the level of regulation varies by country, and some brokers operate in less regulated environments. This can increase the risk of fraud or malpractice, making it important for traders to choose reputable brokers.

No Income-Generating Instruments

Unlike stocks, which may pay dividends, or bonds, which provide interest income, forex trading does not offer any passive income-generating instruments. Profit in forex comes solely from the appreciation or depreciation of currency pairs. This means traders need to actively manage their trades and cannot rely on a steady stream of income from their investments in the forex market.

FAQs About Forex Trading

Q1: How does forex trading work for beginners?

A1: Forex trading involves buying and selling currency pairs with the goal of making a profit. For beginners, it’s essential to start with a basic understanding of how the forex market operates. At Forex Ascenders, we provide comprehensive training and resources to help new traders grasp the fundamentals, including how to read forex quotes, place trades, and understand market trends. It’s recommended to start with a demo account to practice without risking real money.

Q2: Is forex trading real money?

A2: Yes, forex trading involves real money. When you trade forex, you’re buying and selling actual currency pairs with the potential to make profits or incur losses. At Forex Ascenders, we emphasize the importance of proper risk management and provide the tools and guidance needed to trade responsibly. It’s crucial to be aware of the risks and start with an amount you can afford to lose.

Q3: How much money do I need to start forex?

A3: The amount of money needed to start forex trading can vary depending on your trading strategy and the broker you choose. Some brokers allow you to start with as little as $100. At Forex Ascenders, we recommend starting with a small amount and gradually increasing your investment as you gain experience and confidence in your trading abilities. It’s important to develop a solid trading plan and stick to it.

Q4: What is the minimum deposit for forex?

A4: The minimum deposit required for forex trading depends on the broker you choose. Some brokers offer accounts with no minimum deposit, while others may require a minimum of $50 to $500. Forex Ascenders advises selecting a broker that aligns with your budget and trading goals. Additionally, we provide insights into choosing reputable brokers and the factors to consider when opening a trading account.